5 Ways Bitcoins Could Be Transferred to a Sidechain

Bitcoin needs to scale. One way bitcoin can scale is by using sidechains.

This article was originally on bitcoin.com but they're now bcash sheep. Big blocks are not the answer to everything.

The idea of sidechains is something that has garnered a large amount of hype in the Bitcoin community ever since the concept was first publicly discussed in the media back in 2014. The creation of a sidechain essentially allows users to transfer bitcoin to and from other blockchains with different features.

Examples of sidechains currently in development include RSK, which is an Ethereum-esque platform for more flexible smart contracts; Bitcoin Hivemind, which is a blockchain-based prediction market platform.

To “move” bitcoins from the main chain to a sidechain, the coins are first frozen on the main chain and then activated on the secondary chain; this is called a two-way peg. There are currently five well-known options when it comes to who or what should control the locked funds on Bitcoin’s main chain for these two-way peg mechanisms.

- Single Custodian

The simplest way to implement a two-way peg between Bitcoin and a sidechain is by sending the funds to a single custodian to hold on the main chain while the funds are active on the sidechain. The obvious problem here is that this is a completely centralized solution.

In reality, having one party control the frozen funds sent to a sidechain wouldn’t be much different from simply depositing funds at bitcoin banks such as Coinbase or Xapo. In this way, you can view these bitcoin banks’ internal ledgers as sidechains to Bitcoin.

If one centralized party is going to have complete control over the frozen funds, then it may be a better idea to extend the functionality of those funds via a centralized server rather than a new blockchain.

- Federation

Things get a bit more interesting when you replace the single custodian with a federation of notaries by way of a multisignature address. In this model, a federation of entities must sign-off on movements to and from the sidechain, so more parties must be compromised for a failure situation to unfold where the bitcoins frozen on the main chain are stolen.

Blockstream recently released a whitepaper on “strong federations,” which is essentially their vision of a federated two-way peg system. Liquid is a sidechain created by Blockstream that uses the strong federations model. The sidechain is used to transfer bitcoins between centralized bitcoin institutions, such as exchanges, at a faster pace than the public Bitcoin blockchain.

One of the main selling points of the single custodian and federation models is that they do not require any further changes to the Bitcoin protocol.

- SPV Sidechain

The SPV sidechain is the original vision of the decentralized two-way peg as outlined in the original sidechains whitepaper.

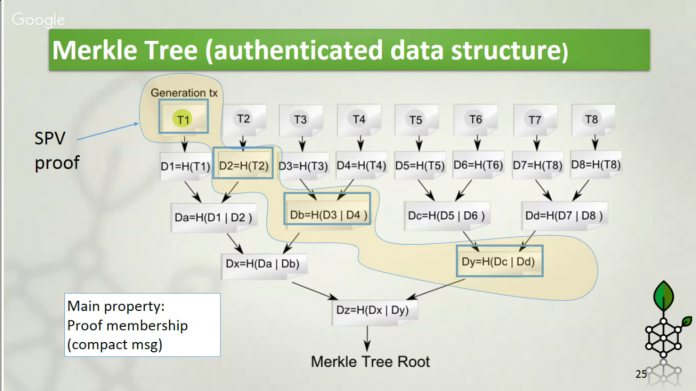

An SPV sidechain uses SPV proofs to move bitcoins to and from the Bitcoin sidechain. An SPV proof is a way to prove the existence of a transaction in a block via a small amount of data related to that transaction’s existence in a particular block.

In other words, an SPV sidechain moves bitcoins between the main chain and the sidechain after receiving proof that a transaction signaling for the movement of some bitcoin between the two chains has been mined in a block. To be enabled, SPV sidechains require a soft-forking change to Bitcoin.

Unlike the other two-way peg mechanisms discussed in this article, SPV sidechains do not give direct control of real bitcoins on the main chain to a custodian; however, the ability for a majority of miners to produce and build upon fraudulent SPV proofs gives them indirect control over the funds, including the ability to send to themselves. Having said that, there are ways to mitigate this issue.

- Drivechain

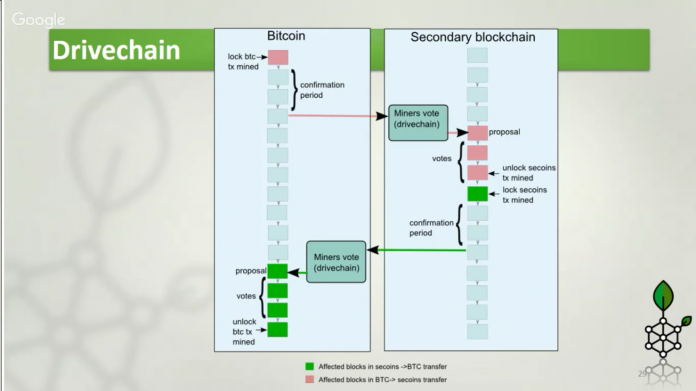

A drivechain is an alternative to the sidechain vision outlined in the original whitepaper. In a drivechain, miners signal the current state of a sidechain. In other words, the miners are essentially the custodian of funds, and they’re able to unfreeze funds for users who wish to move their coins back to the main chain.

The drivechain concept was developed by Paul Sztorc, who is an economist at Bloq and the creator of Bitcoin Hivemind.

One of the key tenets of drivechains is that miners are the least problematic custodians of funds being used on a sidechain from a game theory perspective. According to Sztorc, drivechains can be structured in a way in which any theft of coins frozen on the mainchain would obviously be orchestrated by miners.

“Such brazen theft would indicate [1] that Bitcoin would be (in the near future) without sidechains of any kind, and [2] that Bitcoin itself may be in danger from the miners (and we may need to consider using an alternate proof-of-work hash function),” he explained the impact of this setup in his original post on the topic. Like SPV sidechains, drivechains require a soft-forking change to Bitcoin.

- Hybrids

Combinations of the aforementioned methods of achieving a two-way peg are also possible.

For example, a concept explored by RSK Labs is the combination of a drivechain with the federation model. In other words, both the miners and members of a federation will have to sign-off on a movement of funds from the sidechain back to the main Bitcoin blockchain.

As mentioned previously, a drivechain requires a soft-forking change in Bitcoin, so RSK currently uses a federation-only model.

Although a federation will be used in conjunction with the drivechain model, the federation’s role in the RSK blockchain will no longer be necessary once (if) 90 percent of Bitcoin miners have decided to merge-mine RSK.

Bonus: Extension Blocks and Soft-forked Sidechains

Another idea similar to the concept of sidechains is called extension blocks. Much like sidechains, extension blocks allow users to opt-in to blocks of transactions with different validation rules.

The key difference between a traditional sidechain and an extension block is that upgraded Bitcoin full nodes validate the transactions on the extension block. This means that the extension block is tied much more closely to the main Bitcoin network than a traditional sidechain.

The level of separation between extension blocks and the Bitcoin network is almost non-existent, which means issues on extension blocks are more likely to cause issues for the entire Bitcoin network.

With sidechains, there is a layer of separation between two blockchains, which means the main chain can be protected from issues on the sidechain. For this reason, it’s likely that more experimental ventures, such as RSK, will be implemented as a sidechain rather than extension blocks.

Recently, Bitcoin Core contributor Johnson Lau posted an early version of a BIP draft for effectively increasing Bitcoin’s block size limit through the use of extension blocks.

Since extension blocks can be implemented via soft forks, the features of the extension blocks are essentially opt-in for users. Even in the case of extension blocks with a larger block size limit, users are not forced to upgrade and validate or propagate blocks that are much larger in size. Those who wish to enjoy the level of decentralization offered by 1MB blocks can continue to do so, while those who would like to experiment with much larger block size limits can do so on an opt-in basis.

Although users are able to opt-in to extension blocks, miners must upgrade to continue mining valid blocks on the main chain.

Soft-forked sidechains are similar to extension blocks, with the key difference being that soft-forked sidechains are merge-mined rather than mined as part of the main Bitcoin blockchain.

Original source:" https://news.bitcoin.com/5-ways-bitcoins-transferred-sidechain/

Back when bitcoin.com was actually for bitcoin now they're for bcash. I posted this for bitcoin core news form long ago will be posted here:)