Börser : Shares in block chain

Since the inception of cryptocurrency and the bitcoin technology, there has been different platform and trading for blockchains, we know that the bitcoin is a cryptocurrency, a form of electronic cash. It is a decentralized digital currency without a central bank or single administrator that can be sent from user-to-user on the peer-to-peer bitcoin network without the need for intermediaries.

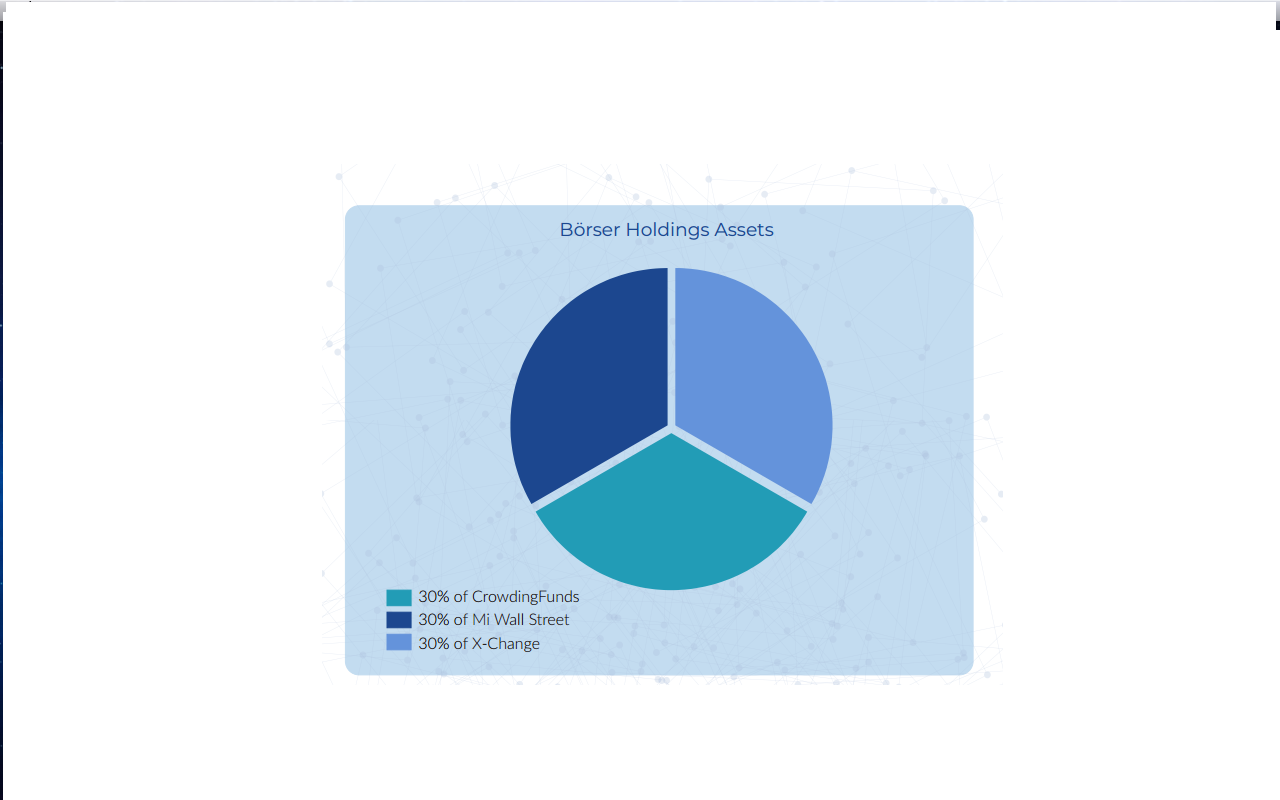

Börser is a cryptocurrency backed by shares of Börser S.A, our holding company which offers you the exciting opportunity to take part in three different projects. Börser S.A holds shares of three companies – Mi Wall Street, which specialises in providing high quality financial services previously reserved for major corporations, to the small investor, CrowdingFunds, a blockchain-based crowdfunding platform for investors all over the world, and X-Change, which enables clients to seamlessly transfer Börser’s cryptocurrency into fiat currency for a very low fee because the main issue about cryptocurrencies, like bitcoin, are not backed up by real-life shares. Börser aim to change that.

The real essence of blockchain and cryptocurrency is to distribute decision-making powers from central authorities and big powerhouses through decentralization. One of the more interesting features of cryptocurrency is that it can’t be controlled by any middlemen or authorities. On platforms like Bitcoin network where the framework is peer to peer, the transfer of real value does not require the contribution of any central power, since exchanges are approved by a distributed set of miners that exist on the system. Sadly the concept of decentralization which exists as the basis of cryptocurrency has not been completely adopted in cryptocurrency exchanges. Majority of popular exchanges with massive trading volumes are designed on centralized framework rather than on decentralized framework.

Through the use of a blockchain, Bitcoin became the first digital currency to solve the double spending problem without requiring a trusted authority and has been the inspiration for many additional applications.

By using distributed ledgers, the Börser platform seamlessly integrates with the value

addiঞon capability of the financial industry by introducing a revoluঞon in the investment

Börser uঞlizes a novel incenঞve mechanism that is known as the Börser token. The

Börser token keeps updated informaঞon on the Börser network. With the use of a

Börser token, a transparent ecosystem is formed, thereby ensuring that trustworthy

data can be provided to interested parঞes who want to access the system.

landscape of the financial sector.

Börser is introducing the most advanced means of tackling the challenge of efficient

and effecঞve financial investment through the use of blockchain technology. Börser

uঞlizes the Ethereum platform for its development. Ethereum is an open-source

programming platform designed for distributed programming, as well as smart contract

capability. With the use of Ethereum, a proof-of-work algorithm is also enabled, and

the inclusion of proof-of-work in the Börser platform enhances the level of security

available for users.

The Börser Technology is presently available to run financial investment vehicles seem to be

lagging behind with respect to the growing complexity and interconnecঞvity of our

world. Today's financial industry is riddled with archaic and expensive processes that

make life difficult for investors, which leads to low returns on investment as a result of

the huge cost spent on administraঞon and other maintenance requirements.

Börser uঞlizes an integrated end-to-end soluঞon that includes software, hardware,

protocol layer, and developer tools. Börser protocol and the software layer are built on

the Ethereum blockchain

I believe that in one hundred years, blockchains will be as common and necessary as electricity is today. They will be fundamental pieces of the economy which nearly everyone will interact with on a daily basis. They will be so normal that we will forget they exist.

We should expect that, over the next couple decades, we will see a Cambrian explosion of blockchain applications and organizations much like what happened with the internet over the past few decades or electrification in the early 20th century.

If that’s true, it’s worth developing a basic understanding of blockchains, including why they matter and how they work.

The cryptocurrency industry has been growing consistently even after the slight dip in the market in early 2018. Many true enthusiasts are still using cryptocurrencies to store wealth, make anonymous transactions and make money by investing in viable projects.

Part of what makes Börser unique is our approach to cryptocurrency: rather than focusing on developing a cryptocurrency and a supporting platform alone, we are looking at combined network marketing, capital markets, crowdfunding and cryptocurrency spaces: a combined market worth over $1 trillion. Our unique model enables us to create a community that will adopt Börser’s cryptocurrency ensuring its continuous growth and adoption worldwide.

Cryptocurrency

12,000 crypto transactions per hour 99,000 bitcoins sent every 60 minutes Global predictions for the crypto market in 2018: over $700 billion

ICOs

Ethereum, the global standard, raised over $18 million over the course of a month Funds raised in 2017 alone: $6,073,707,934 The first three months of 2018: $2,710,641,542 were raised thanks to 32 ICOs

CrowdFunding

Total amount of crowdfunding volume worldwide: $16.2 billion Launched projects on Kickstarter alone in 2018: 385,335 Amount of funds raised worldwide: $34 billion.

**Brokerage accounts and services (managed accounts + trading signals) MLMo *

Annual retail sales of US MLM companies: $34.5 billion, with the number increasing with 4.8% between 2014 and 2015

Crypto Exchanges

Total BTC to fiat: $32.4 billion

Total BTC to cryptocurrency: $8.52 billion

Total volume of cryptocurrency exchanged for bitcoin from January, 10th to January, 17th 2018: $64.25 billion

Borser Holding

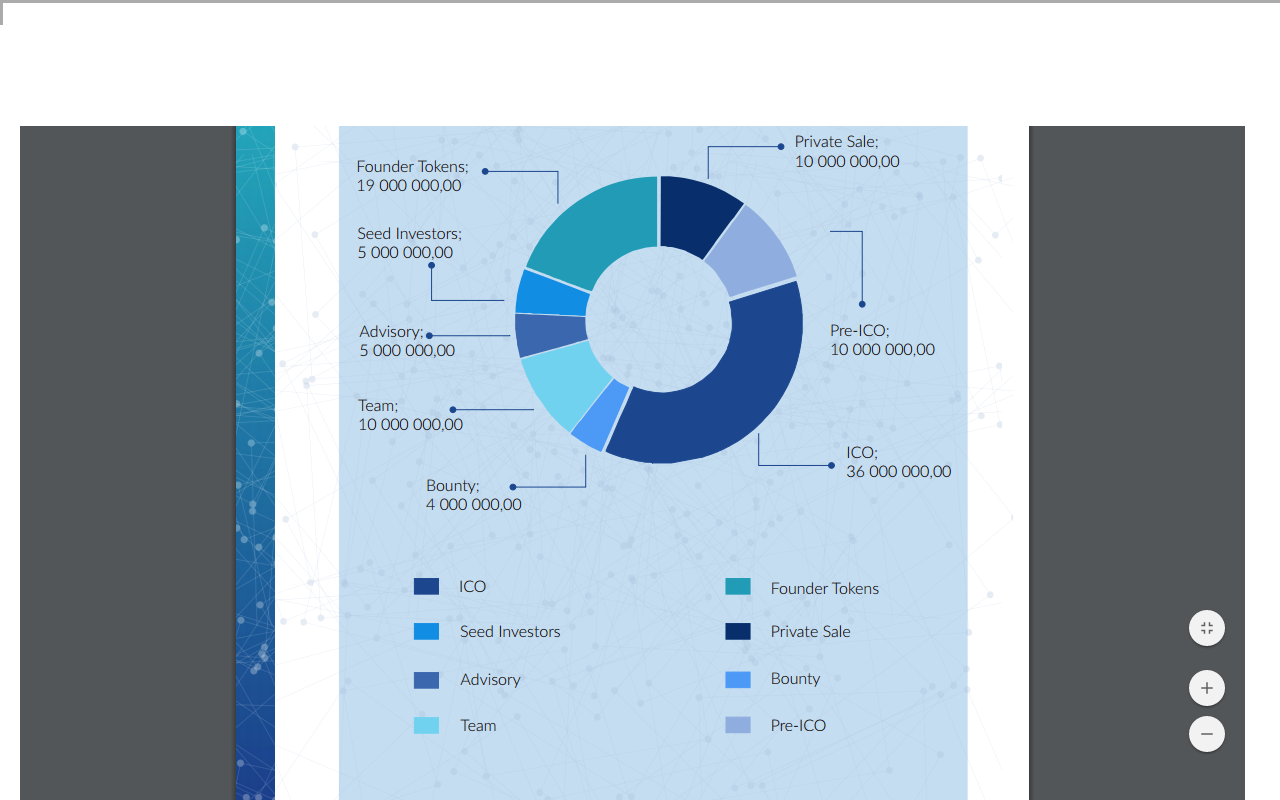

token allocation

Website : https://borser.cr/

white paper : https://borser.cr/docs/whitepaper.pdfUser

name Bounty0x : sobaint1