FINTRUX-NEW SOLUTIONS DISRUPTING CONVENTIONAL P2P LENDING PLATFORM WITH BLOCKCHAIN TECHNOLOGY

Challenges of Conventional P2P Platform that FintruX is solving with Cutting Edge Blockchain Technology

• Lending Club is the world’s largest P2P lending platform with over $20 billion in loan issuance

The company was recently faced a scandal surrounding the founder Renaud Laplanche. He was forced to resign after an internal investigation found improprieties in the company’s lending process, including the altering of millions of dollars’ worth of loans.

• Although the event damaged the reputation of Lending Club

• Lending Club operates as an intermediary between borrowers and investors. Once a loan has been funded, the money is released to the borrower by a partner bank.

• For non-performing loans, Lending Club charges investors 18% of any amount collected if no litigation is involved. If litigation is needed, investors must also pay 30% of hourly attorney fees.

• Prosper

Launched in 2006, Prosper was the first P2P platform in the US. It has since funded over $6 billion in loans and serviced over 2 million customers. Prosper only offers unsecured consumer loans and does not make SME loans.

Upstart

• Launched in 2014 by a bunch of ex-Googlers

• Interest rates range from 4% to 26%, depending on grade.

• Funding Circle

• Funding Circle started in the UK and entered the U.S. in October 2013. The company only makes business loans and operates in the US, UK, Germany, and the Netherlands.

• Interest in the U.S. Rates ranges from 5.5% to 27.8%, depending on grade.

NEW SOLUTIONS DISRUPTING CONVENTIONAL PSP LENDING PLATFORM

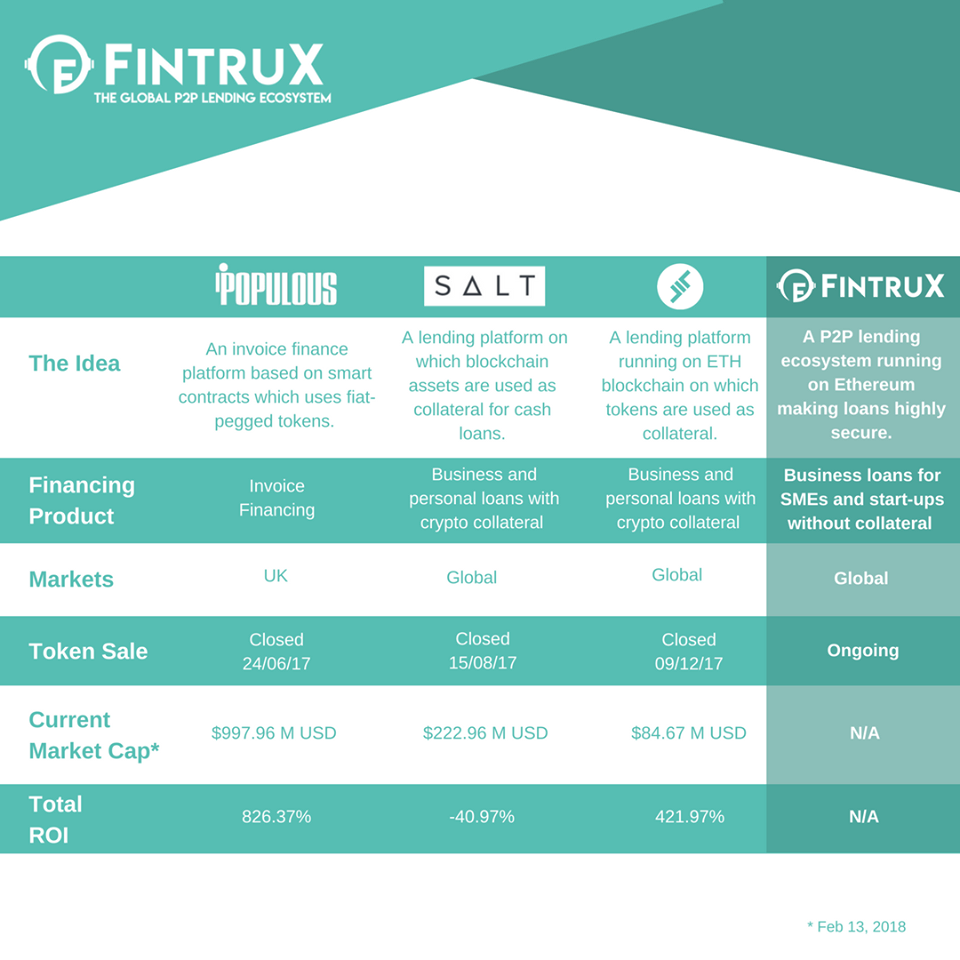

FintruX Network offers a new marketplace and automated administration platform for startup businesses as borrowers, authorized investors and finance house as lenders, and specialized service agents as partners. By disrupting the approach of finance, we established a secured platform for borrower and lender to transact business with advanced security processes for both parties. FintruX Network is an ecosystem platform for unsecured loan parties and opportunitiesto transact business without impending challenges and give people freedom to choose.

Fintrust a new disrupting decentralized P2P disposition marketplace power with blockchain technology to simplify the lending and borrowing process with assurance.

FTK Token is only fee charge on the platform with risk of lending money and with a reserve of 5% token to facilitate any lender who has borrowers default .

How massive is the current market?

There is close to 80% of growth on yearly basis in the United Kingdom for period 5years starting from 2010 up to 2015 in P2P lending market. The currently growth rate was as a result of massive internet penetration which makes it easier ,banks being less willing to lend cash and borrowers are facing with challenges of higher interest rates from their banks.

Conventional main street banking institutions do provide unsecured loans, but it's become progressively tough to induce them and unbearable higher interest rates are being charged.

The advent of P2P lending platforms provide individual investors the possibility to lend cash and provide people or businesses the possibility to receive an unsecured loan faster.

Value Proposition of FinTruX

The existing P2P lending platforms are not 100% transparency in their dealing and are not actually P2P as they use intermediates.Blockchain and smart contract on the ethereum network offer robust advantages which makes p2p completely transparent and offer value addition to the lender and borrower such as:

FintruX will establish business relationship with top-ranking credit scoring and Know Your Customer(KYC) agencies that will enable lender to evalutate credit worthiness of lender and mitigate their risk

Likewise, decentralized rating system platform where parties will have access to review each other after a successful business transaction have taken place in order to help each of the parties to know about a prior business transaction with track record timely repayment of loans to the lender on both parties.

FinTruX T provide a platform that facilitate a simple and easy lending and borrowing process with reasonable percentage charges in the company token. Compare to other conventional platform that charge out of pocket flat fee.

Decentralized blockchain: By utilizing Ethereum smart contracts it'll be straightforward to produce a completely verifiable history with no risk of something being fraudulently altered.

Fintrux business model

10% will be charge as over col-lateralization which is able to be split into completely different pools, every pool are selected by same credit package.

5% of the tokens also will be control in reserve for any emergencies.

The platform also will charge little fee on every loan that's created and a little charge for service delivery for every action that's performed on the smart contract.

FTX token utility

The new FTX token is used for all of the key features on the platform. Every participant on the network platform will need to keep a little quantity of ETH on the platform to get GAS fees.

ICO Details

Pre-sale dates: January 6 till January 21.

ICO dates: Feb 7 till Feb 28.

Price: one ETH= 1500 FTX.

Min amount: 0.1 ETH.

Summary

Currently, top-rated tech companies in the world are in the P2P lending industry with higher growth rate. Several of those firms charge high-interest rates and remains tough for businesses to get funding from banks.

Now FinTruX offer the best solution with the power of Blockchain Technology

Web : https://www.fintrux.com

https://www.fintrux.com/tokensale.aspx

Whitepaper: https://www.fintrux.com/home/doc/whitepaper.pdf

Twitter: https://twitter.com/fintrux

Facebook: https://www.facebook.com/FintruX/

Telegram: https://t.me/FintruX

ANN : https://bitcointalk.org/index.php?topic=2286042

Author:Abinvent

https://bitcointalk.org/index.php?action=profile;u=1299546