VIAZ - decentralized funding platform.

Introduction

VIAZ could be a localized application (“DAPP”) bridging the gap between lenders and borrowers of decree and digital currencies

VIAZ can use VIAZ sensible Contracts for transactions initiated on the VIAZ Platform. even as similarities and variations exist between digital and decree currency, a more in-depth examination of VIAZ compared to the standard banking industry reveals each convergence and branching characteristics.

A notable similarity is that the VIAZ Platform, by golf shot potential borrowers in direct contact with potential lenders, empowers users to borrow, lend, and transfer currencies throughout a world network. But, not like banks, the VIAZ Platform can offer a additional economical, price effective and secure service for all users.

The first DAPP to run on the Tezos blockchain, a self-amending crypto-ledger, the VIAZ Platform has inherent benefits compared to different competitors within the bazaar.

The VIAZ Platform can connect digital assets, equity, and decree in ways in which not antecedently doable thanks to boundaries inherent within the ancient centralized banking area. The VIAZ Platform can bring the planet nearer by disassembly these boundaries and empowering people to require management of their own money destinies.

Viaz Platform

The utility of the VIAZ Platform is to supply a localized platform for the introduction of prospective lenders to prospective borrowers, connect its users, and act as a passage between the cryptosphere and decree currency.

Within the crypto loaning area, different platforms presently exist, every with their own utility and practicality. The VIAZ Platform’s aim is to enhance upon, and supply a mess of utility and practicality beneath one platform. By the time our Token launches, the VIAZ Platform can have a operating example. The betanet can launch before the Token Launch, and also the launch of the mainnet can occur shortly thenceforth. The VIAZ Platform are going to be absolutely practical at now.

Viaz Debit Cards

The VIAZ Platform are going to be issued with ‘VIAZ’-branded debit cards which will be operated by a authorized bank and not by the corporate. These cards are going to be used globally on established open-end credit payment processor networks. people are going to be ready to choose daily and monthly limits on their several cards. to boot, users are going to be ready to disconnect cards from their VIAZ Platform accounts just in case of a lost or purloined card while not having to contact a 3rd party for help. VIAZ is actively engaged in voice communication with a minimum of 2 completely different decree banking partners.

These options are going to be on the market on IOS and automaton operative systems. Mobile apps are going to be on the market to VIAZ Platform users freed from charge and can build daily VIAZ Platform operations additional accessible.

The VIAZ Platform can offer lenders the chance to bid on funding opportunities supported completely different interest rates. for instance, a recipient will provoke $5,000.00 at 12-tone system p.a.. it'd take some hours or days to fill the order, however if one loaner needs to fund the loan at the next rate of interest, they'll be ready to do thus in a flash. This makes the method quicker for the recipient, and also the loaner can have a chance to earn additional interest.

VIAZ Tokens

The Tokens area unit the native token of the VIAZ Platform. Token holders area unit rewarded with monthly airdrops supported their participation within the following Platform connected Actions (or “PRAs”):

victimisation Tokens as collateral for loans we wish to permit users to utilize their Tokens as collateral for loans on the VIAZ Platform. To incentivize this activity, Token-backed loans can incur a reduced charge (currently this can be a five hundredth discount, though this could amendment in future). the employment of Tokens as collateral also will cut back the on the market provide of Tokens on the market.

marketing Tokens through the VIAZ Platform VIAZ Platform loan repayments area unit made from 3 components – payment on the principal, interest payment and a charge. The interest payment and repair fee should be paid in Tokens (at the decree equivalent price at the time of the repayment). This generates a requirement for Tokens, as borrowers can ought to own and/or acquire Tokens to satisfy their monthly repayments. to help with this, the VIAZ Platform can permit Token holders to form sell-offers.

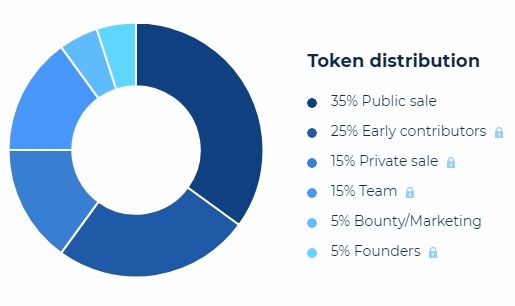

Token details

ICO start date : 15 Feb 2019

ICO end date : 15 Apr 2019

Ticker : VIAZ

Type : Utility-token

Platform : TEZOS

Accepted Currencies : BTC , ETH

Tokens for sale : 525,000,000

Soft cap : 8,000,000 USD

Hard cap size : 30,000,000 USD

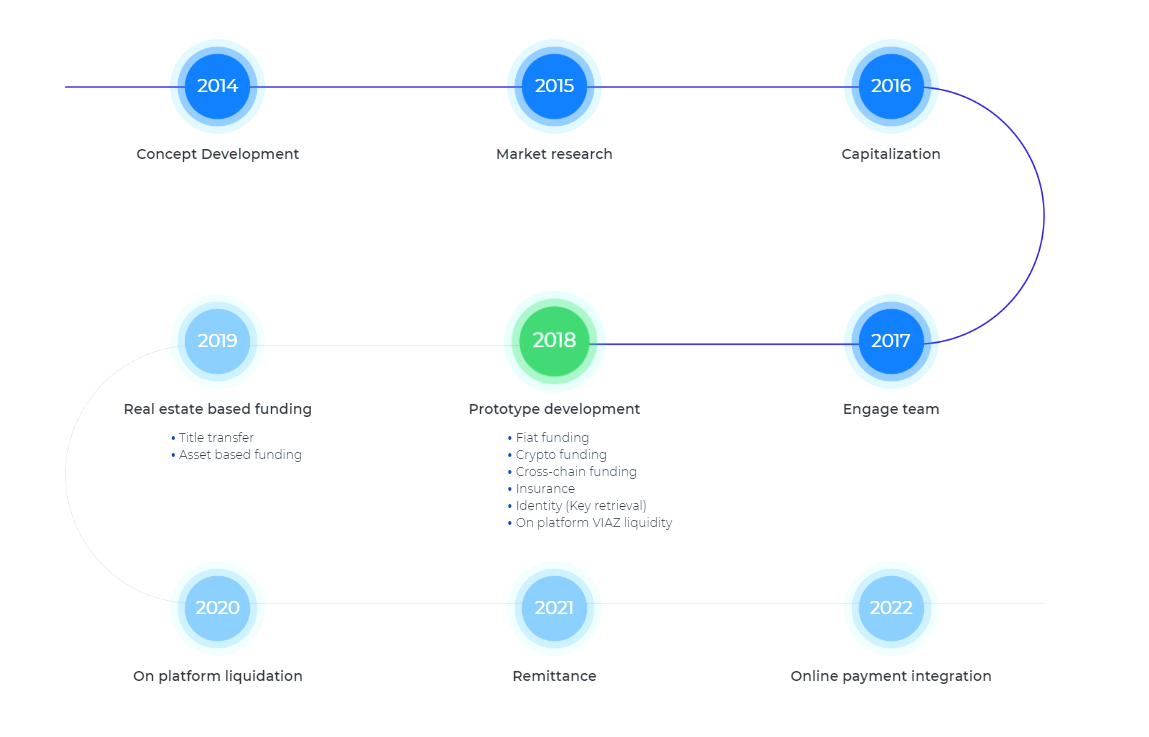

Roadmap

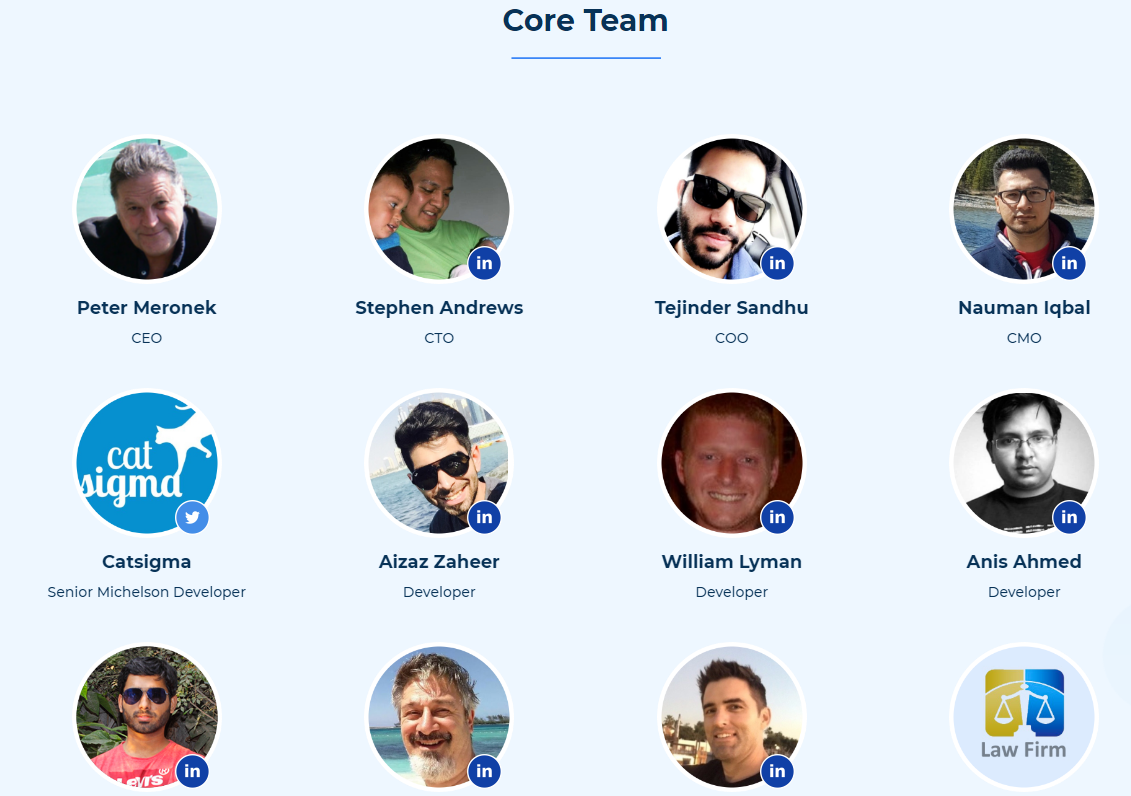

Team

You can use this information for a detailed study of the project:

Website: https://viaz.io/

Whitepaper: https://viaz.io/documents/Viaz-Whitepaper_EN.pdf

Twitter: https://twitter.com/ViazOfficial

Facebook: https://www.facebook.com/viazofficial

Telegram: https://t.me/ViazOfficial

Linkedin: https://www.linkedin.com/company/viazofficial/

Medium: https://medium.com/@ViazOfficial

Bounty0x username: sancho9905