Neluns Ecosystem

Hello everyone! A few days ago, I’ve spoke to you about Neluns project. Today, we’re going to consider in details all options of this new ecosystem.

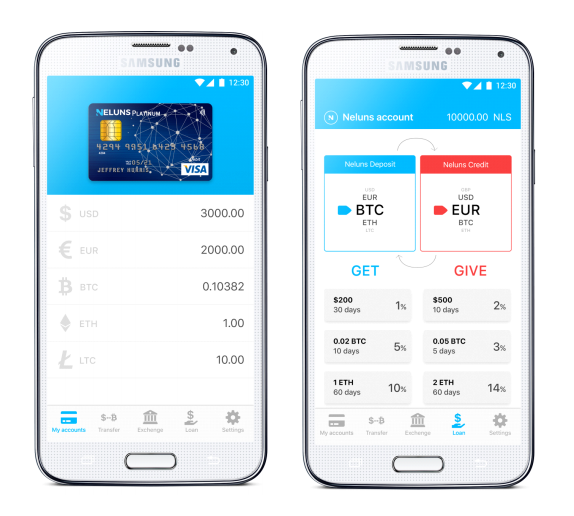

Mobile app and its types of cards.

Like I said in my last article, this ecosystem comes with a mobile app. For what it is used for?

Well, it helps to make easier interaction with the platform. It concerns to transferring funds, exchange operations, and also execution of credits. All of this processes, taking a few minutes or seconds.

This is not all features! Using Neluns mobile app, user is able to use the exchange avaible inside the ecosystem, and to trade with your lovely cryptocurreny pairs, or to make deposits into your profile/make transactions all over the world.

So like you can see, Neluns have a unique solution to simplify the interaction of users with their ecosystem and to make it more confortable for them.

The pictures below demonstrates the work of the application.

Neluns will be connected to SWIFT, and after that it will be connected to some of popular payment systems like (Visa, MasterCard, and others)

Also, Neluns implements next functions to its ecosystem:

- • Bank card will be given to all clients.

- • Authorization of payments at any request.

- • Debiting funds from customers accounts for maintenance of accounts.

- • Availability to withdraw cash money in any ATM’s of MasterCard, Visa, or American Express, all over the world.

- • Security (If it is need to, your card can be blocked)

Every user is able to pay for any paymens with his card. Unlike ordinary banks, payments with Neluns card accept using of cryptocurrenies apart from fiat funds. Paying with cryptocurrencies, your funds will be changed into fiat with actual Neluns Exchange market prices.

Another feature that will help to simplify users interaction with the cards, is contactless paying option of your cards (MasterCard Contactless, Visa paywave, Apple Pay, Samsung Pay, Google Pay). It means that the payments can be made without introducing your pin.

There are 4 types of Neluns card:

- Lite Card – for users that have passed only first floor of verification process (email address). This card allows user to participate in Neluns Exchange trades, but trade sums can’t overpass 300$.

- Silver Card – for users that have passed the second floor of verification (authorization via social media and phone number). It allows to user to participate in Neluns Exchange trades, but trade sums can’t overpass 500$.

- Gold Card – for user who have passed the third floor of verification process (mobile number and ID). It allows user to take advantage of all services provided by ecosystem, among which is the Insurance too. In this case, there are no limits for transactions.

- Platinum Card – for users that have made a deposit of at least 5000$ in Neluns Bank. The advantages for this case are the same as with the Gold card.

Deposits:

Neluns ecosystem offers services of deposits. You can deposit you funds in any value, in any point of world. For access this services, you need to use an ATM or to make a transaction. In your account, you will be able to convert in any currency do you want your funds to be (For example (EUR-USD, ETH-BTC). It is happen instant.

Loans:

There will be various types of loans for all type of users. Here are a few of them:

- • Targeted/Non-targeted loans

- • Broker loans and Margin Trading

- • Renewable and Nonrenewable Credit Lines

- • Overdraft-loans

All loans will be provided to user in a short time. For checking the trustworthiness of borrowers, Neluns will use its own new technologies and algorithms, such as Big Data and AI.

Conclusion:

Today we have reviewed Neluns Ecosystem in details, showing the advantages and new solutions that have been providing in each part of this platform. In my opinion, it has great prospets in nowadays market. Thank you for being here and till next reviews!