KABN

With my research, I found this project in which I really put my faith: KABN. Very likely you haven’t heard about them, project is made by great team members. Nevertheless, guys have an advantage, many other teams does not: already existing product made on a very perspective field. But these are not all pluses I found in this project. Below you can read the analysis and decide on your own, do you want to send some pennies to the pot.

Introduction

The following review, is a detailed summary and analysis about the KABN Project. This will be helpful for everyone who wants to learn more and get an objective view about the KABN Project.

The KABN Network is an integrated suite of financial services that includes the Pegasus Flyte Visa Card, an approved crypto-linked prepaid Visa card and mobile integrated multi-currency banking wallet; KABN KASH, a robust loyalty and engagement program and the network anchor, KABN ID, a patent pending, Always On, GDPR complaint, blockchain and biometrically based, identity verification and validation platform. KABN ID is free to use service for consumers and provides continuous monitoring and proof of identity online and in conventional marketplaces.

KABN supports internationally recognized documents for Know Your Customer (KYC) regulations. In addition, for issuers of private or early stage assets, KABN provides qualification for investors in the United States and Canada, and source of wealth verification for investors in Europe. To date, KABN has screened individuals in the following countries: Armenia, Australia, Bangladesh, Belarus, Canada, Ecuador, Hong Kong, India, Indonesia, Ireland, Latvia, Malaysia, Nigeria, Philippines, Romania, Russian Federation, Sri Lanka, Thailand, Turkey, Ukraine, United Kingdom of Great Britain and Northern Ireland, United States of America and Vietnam. Other countries will be added as they come on board. Customers on the KABN network receive ongoing Anti-Money Laundering (AML) monitoring and requests to confirm or update personal information that is expired or out of date. Financial technology startups can outsource this operational burden at no extra charge.

Issuers and financial technology startups operating at a global scale are required to comply with United States banking regulations. Know Your Customer (KYC) regulations involve managing private and sensitive personal customer information and the third-party verification of these documents. Anti-Money Laundering (AML) regulations require screening and monitoring participants against international sanctions, politically exposed persons flags (PEP), and adverse media lists. Issuers and startups must additionally comply with European regulations around data privacy and source of funds. General Data Protection Regulation (GDPR) requires all technology services, encompassing financial technology services, to give users the ability to retrieve all personal data and the right-to-be-forgotten. Management has determined that existing compliance and customer onboarding is often manual, time-intensive, and costly. In-house compliance programs are typically inadequate and/or data gathered is incomplete, inaccurate or unverified. Third-party services and compliance experts may be too expensive for issuers that are required to perform compliance in order to raise capital.

For transactions related to international blockchain-based offerings, many issuers are unfamiliar with global regulations outside of their jurisdiction. In some cases, issuers do not comply with U.S. Securities and Exchange Commission (SEC) regulations and have improperly sold tokens into the US market without an exemption to registration. Over the course of 2018 the SEC significantly increased the scope and instances of repercussions, often forcing issuers to return all funds to investors, sometimes resulting in charges and convictions. In today's market, compliance has become central to any business attempting to raise funds.

KABN Ecosystem

Friction Free Global ID: KABN ID powers your Digital Twin with a Friction Free and Always On, no cost 24/7/365 verified ID service for online and other services.

Loyalty & Rewards: The Pegasus Flyte program will also offer a no-cost, robust loyalty and engagement platform called KABN KASH.

Features of the Platform

KABN Card: KABN has been approved to issue a reloadable prepaid Visa card starting in Europe in Q1-Q2 2019 and intends to expand to other jurisdictions. Each consumer customer who is screened and passes the KYC/AML on the KABN platform is eligible to receive a KABN-issued Visa card and corresponding banking wallet. The KABN Card program aims to allow spending crypto in the real world. Presently, it is difficult to convert cryptocurrency into local currency. Exchanges increasingly offer trading pairs with stable coins instead of actual local currency. In many cases, withdrawals take weeks via international wire transfers. There are certainly exchanges that allow same-day withdrawals but these, management has found, are rare and in the minority. In certain cases, transfer fees are only viable for large deposits and withdrawals. With the KABN Card Consumers can immediately convert their crypto currency into fiat.

KABN KASH: KABN’s loyalty program is designed to engage members of the KABN whitelist and capture data in targeted offers and services. Segmented analytics will be used to determine and segment the highest-value, mid-value and low-value customers. The Company will target

messaging to increase frequency of spend and to graduate customer behaviour towards

higher-value membership. Phase one is the roll out of KABN KASH. This program provides KABN customers with the opportunity to transact with their Visa card at e-commerce websites and brick and mortar stores with an added value of an affiliate shopping mall experience. As a card holder shops within our environment, each transaction produces a commission back to KABN.

Other Features include;

● Platform links blockchain wallet(s) to identity

● Biometric multi-factor authentication (in progress)

● US Patent pending process for validating PII with the use of Blockchain Registries

● Continuous AML monitoring for financial crimes and related adverse media

● Continuous compliance monitoring to renew or expire documents

● Forensic wallet review capabilities

● Separation of (PII) and Functionality in compliance with GDPR

● GDPR and Privacy Shield (US – pending) Compliant

● Blockchain based registry manages ID and other “Markers”

● Accredited participant validation for US / Canada and for European Source of Wealth

● Screened response time generally within 3 business days

● Settings to manage account / preferences / offers

● Webhooks for 3rd party Application development or multiple points of integration

KABN Benefits

● Instant KYC / AML processing for known customers

● One-time registration and ongoing monitoring - meets all legal requirements

● Separates PII from technology and remains compliant with jurisdictional privacy

requirements

● Issuers can bring future token offering to already approved customers that have a

propensity to buy into STO's and reach qualified participants

● Blockchain registries provide up-to-date information on-chain

● Customers can provide further "aggregate" information to receive early access to STO's

and other commercial offers (under GDPR privacy provisions)

● Privacy Shield (US – pending) means US customers follow the same principles as

global privacy community.

KABN Advantages

● No refresh or ongoing costs

● Eliminates need for costly technical integrations

● Single-source system for all active KYC and ongoing AML monitoring

● Single-source system for all accreditation / source of wealth

● International support for documents and languages

● Lower data and PII management costs

● STO’s/Exchanges need only to “PING” the Blockchain registry to allow or deny

regulated actions such as purchasing tokens

● Compliance with the most stringent privacy and personal information requirements for

all jurisdictions

● Keeps PII data on hand current and flags changes in status

● As a Gibraltar Company, AML flags are reported immediately

● Customers don't have to worry about multiple ID document requests and sharing with

unknown parties – One and Done

● Clients don’t have to worry about secure document storage and potential GDPR

violations.

Unique Team

The KABN team comprises of topnotch professionals in their domains. They have ambitious goals which will enable them to set new standards for the Market. To achieve this goal a strong Team is built with all the necessary skills, talents and long-time experience needed for the project. Most of the team members on KABN have verified LinkedIn profiles. This is all good because the more transparency a company have in regard to their team, the more trustworthy they typically are.

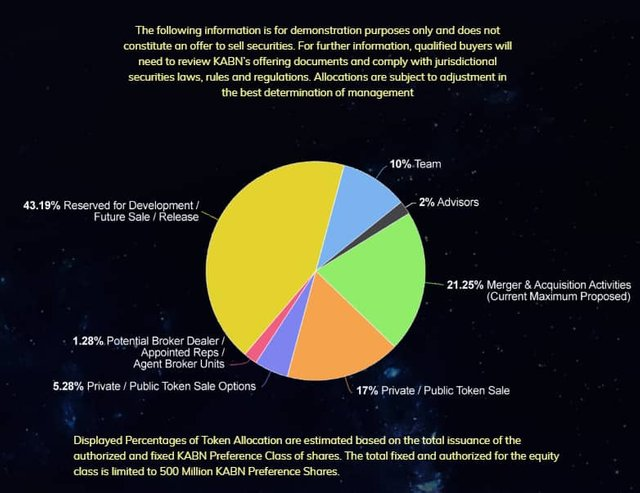

Token Details

Token: KABN

Type: Utility

Price 1 KABN = 0.2 USD

Platform: Ethereum

Accepting: ETH, BTC, Fiat

Country: Gibraltar

Whitelist/KYC KYC

The KABN Equity Token, "advanced security" or "computerized endorsement" is a proportionate to the KABN Preference Equity Share and has every one of the rights and benefits of those offers. KABN is out to make transactions easier for crypto users. The launch of this crypto-linked card and the mobile wallet is an indication of better things to come in the crypto-sphere.

KABN’s mission is to create a world-class suite of products and services that support the decentralized market economy, globally enabling consumers to take control of their digital identity and personal data, connecting them with Cryptocurrency-linked financial services and loyalty platforms.

For more information about this project, please visit:

Website : https://www.kabntoken.com

WhitePaper: https://www.kabntoken.com/wp-content/uploads/2019/03/KABN-Company-Overview-Summary-V1.2.pdf

Medium : https://medium.com/@KABN

Twitter : https://twitter.com/KABNNETWORK

Telegram : https://t.me/kabn_network

LinkedIn : https://www.linkedin.com/company/kabn/

Bounty0x Username: nugezmils