BITBOND STO - Germany's First Security Offering

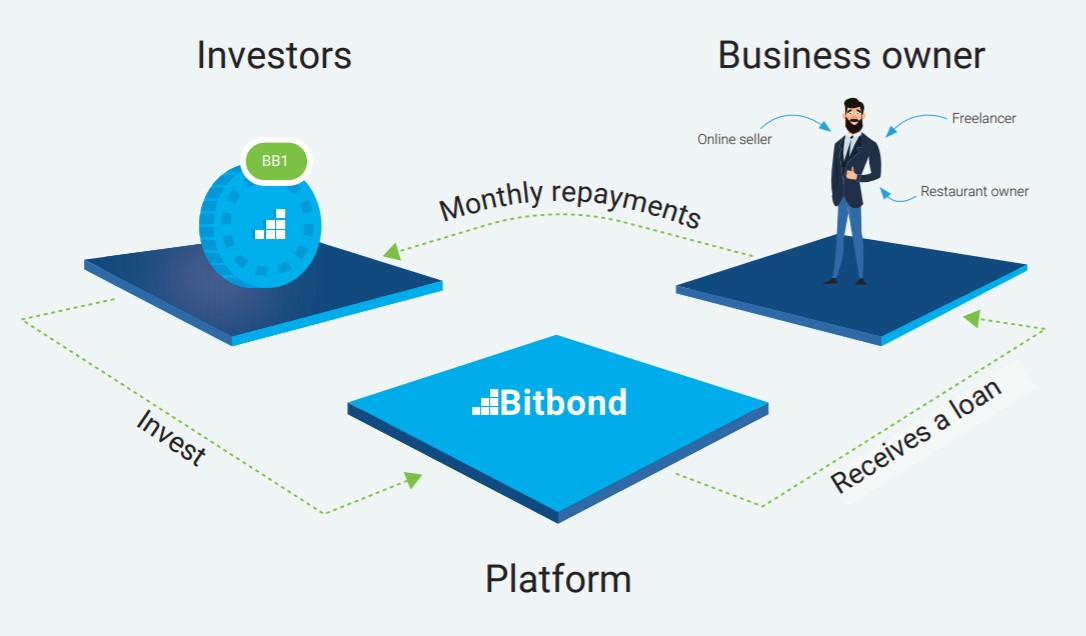

In modern times it is difficult to imagine that sphere where the cryptocurrency would not have got. The relevance and popularity of cryptocurrency make you think about ways and technologies that will ensure their accessibility for ordinary people. Finally, the cryptocurrency reached the business lending sphere. Here is the first decentralized global platform called Bitbond for lending business. The company operates in more than 80 countries. The main office is located in Berlin. The idea of the project did not arise by chance. Notwithstanding the many proposals, small and medium-sized businesses still face difficulties in arranging loans for their own business. Many turn to banks and other financial institutions, others are looking for various sponsors. But not everyone can agree and implement the right option. Many have to say goodbye to his dream. However, there was an alternative to the traditional method of lending. The so-called p2p lending. It has several advantages. Firstly, investors now have the right to choose a partner from which they need to get a loan, as well as to track all stages. Secondly, the platform is developed using blockchain technology and has an extensive database that performs analysis and provides information about all customers. In p2p lending, borrowers offer a quick and easy-to-service loan with attractive fees.

About project

The project which will be discussed today is called – Bitbond. Bitbond is the first decentralized business lending platform operating worldwide in more than 80 countries. The project belongs to Bitbond GmbH, which is officially registered in Berlin (Germany) and has one of the most worthy financial licenses of the country from the BaFin regulator. For the founders of Bitbond it is a great honor and a tribute from the German regulatory authorities. Given the fact that this is the first blockchain platform in Germany, which received this license.

If you touch a little bit on the history of the Bitbond project, for all these years (since 2013) the company Bitbond GmbH has already successfully established itself and show itself in many countries of Europe and Africa. It has accredited more than 3,000 small and medium-sized businesses worldwide, totaling more than 13 million euros. At the current time, the founders of Bitbond are able to provide monthly loans in the amount of about 1 million euros, which is a worthy result, which the developers assure they do not intend to stop.

Advantages and features

Of course, the idea of the Bitbond project did not appear by chance, it was preceded by various problems that have met and still occur in all countries of our world. Almost every second small and medium-sized entrepreneur is faced with the lack of adequate funding for their business ideas or a ready-made working model. As a rule, they seek financial assistance from various banks or other financial institutions. Which in turn do not always have the opportunity to support every entrepreneur.

The concept of Bitbond eliminates this problem, helping to develop small and medium-sized businesses in all corners of the planet by means of high-tech tools and technologies. All they want to offer mothers now is to become part of this direction and help to develop business lending to small and medium-sized businesses became more affordable.

Token

To do this, the founders of Bitbond are ready to offer us security tokens, each of which is a bond based on the BB1 tokens proposed by the project. If we talk about the technical side of the issue, the BB1 security tokens are created on the basis of the Stellar Lumens blockchain and will be distributed by means of STO, as well as work with all online wallets that support this blockchain.

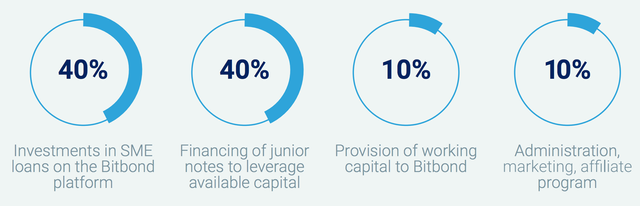

The use of borrowed funds is shown in the photo:

Partnerships

Team

Conclusions

The existence of such a project as Bitbond proves once again the effectiveness and relevance of the innovative blockchain technology. Innovative technologies, various studies, the automated credit assessment, a powerful algorithm for analyzing data based on artificial intelligence, all this allows the company to be a leader in the lending market and bring profit to its investors in the near future.

You can use this information for a detailed study of the project:

Website: https://www.bitbondsto.com

Telegram: https://t.me/BitbondSTOen

Lightpaper: https://www.bitbondsto.com/files/bitbond-sto-lightpaper.pdf

Prospectus: https://www.bitbondsto.com/files/bitbond-sto-prospectus.pdf

ANN thread: https://bitcointalk.org/index.php?topic=5130337.0

Facebook: https://www.facebook.com/Bitbond/

Twitter: https://twitter.com/bitbond

Medium: https://medium.com/bitbond

Reddit: https://www.reddit.com/r/BitbondSTO/

Instagram: https://www.instagram.com/bitbondofficial/

Youtube: https://www.youtube.com/user/Bitbond

Author by:

Bitcointalk username: Werlot

STO affiliate link: https://www.bitbondsto.com/?a=VJAKRI

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2558487

Uniqueness 100%: https://text.ru/antiplagiat/5c59977738030