Distributed Credit Chain - Why you must know about this project.

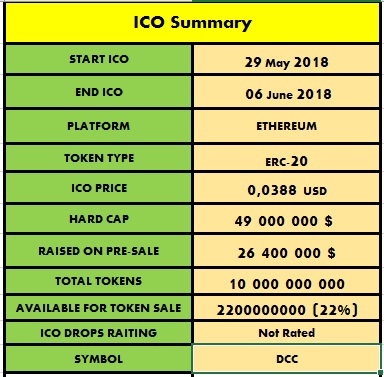

Hello dears! Today I will make a small review of the DCC (Distributed Credit Chain) project, the ICO of which will begin tomorrow, and $ 25 million was collected at the PRE-ICO. Go!

What's the project?

The main idea of the DCC founders is to create a distributed banking system, which will improve the current banking system, including document flow, distribution of credit income, confidentiality, etc., using blockchain technology.

I would like to examine the shortcomings of the current centralized banking system by the example of lending.

80 % of the income of the average bank is a credit and deposit spread. In some States, the Central Bank provides for 3-5 % of the credit and deposit spread, but these are only initial rates for large companies; for small and medium-sized businesses, these rates may be 7%. That is, it turns out a situation in which the system gives more opportunities for monopolists who are large companies. Also, at the present time there are a large number of intermediaries between borrowers and creditors, which accordingly increases the cost of credit for the borrower. As a result, people are increasingly thinking about a system that will be able to place on one platform all the players of the banking sector to work together : creditors, borrowers, risk control specialists, insurance companies and collection bureaus, resulting in the fact that creditors and borrowers will work directly with each other, reducing the credit and deposit spread and calmly develop their business. DCC plans to become such a platform in the near future by introducing blockchain technology and smart contracts.

What problems will DCC solve?

1. First and foremost, the establishment of the DCC aims to eliminate centralization and monopoly. In this system, each lender will be able to choose a borrower in a decentralized market with great competition. Pricing policy will be dictated directly by the market, not by intermediaries and speculators. Plus, all market participants will receive a profit by providing calculations and algorithms on the blockchain.

2. Also, one of the problems of the current banking system is the provision and storage of personal data from third parties. With DCC, users ' data will be stored in their on-premises or cloud encrypted storage. Personal data can be sent to the recipient in encrypted form so that only he can view them. Alternatively , there will be a zero-knowledge proof protocol, where the examiner can verify the accuracy of personal data without disclosing the original text of the documents. All this also reduces the risk of personal data leakage, as they will not be stored in a centralized storage.

3. Also, through the introduction of blockchain and AI, organizations issuing loans will be able to better control the risks. The blockchain will disclose the algorithm of the creditors ' risk strategy, and the borrowers will filter the creditors according to these algorithms in due time, as a result of which the borrower will apply only to the organization that will be able to give him a loan according to the algorithm. In the end , reduced the cost of data processing and increases the efficiency of transactions.

4. Preparation of credit rating open to all market participants. A kind of credit history for borrowers. With the help of blockchain technology, all records in the block will be publicly available and not available for change.

5. The system of user account identification will be implemented using DCCID, which will be generated using a pair of public and private keys to form the address. This ID links the DCC account (credit request, credit, redemption information) to the person's real attributes ( real name authentication, Bank cards, and property) .

Technical implementation

Team

Stewie Zhu

Founder of Distributed Credit Chain

Serial entrepreneur. Before he founded DCC, he led a leading SaaS company in China and led the development of Internet credit systems for multi-billion trusts. In the future, this company was successfully sold to a publicly registered company.

• Oxford University M. s in Financial Economics

• Ph.D. (Candidate) in Finance, London School of Economics

• Research focusing on finance and game theory

Stone Shi

Co-Chief Researcher at the Distributed Credit Chain

For 7 years he served as Vice President of J. P. Morgan. With significant talent in coding and specialization in python programming, Mr. Stone Shi is an expert in quantitative research, derivative pricing, and quantitative model risk analysis.

• Nanjing University, Computer Science/Math

• Nanjing University, Electronic Science and Engineering

Dr. Daniel Lu

Chief Innovation Officer at Distributed Credit Chain

Danielle Lu is one of the few experts in mathematics and financial engineering. He has strong fundamental training and extensive experience in banking, wholesale and retail trade and asset management. He is also a specialist in Finance, thanks to his experience at Deutsche Bank and Blockchain. It oversees the development of DCC products for financial institutions.

• Ph.D. in Mathematics, Yale University, USA

• Postdoctoral Research in Financial Engineering, focusing on the Representation Theory, University of Leipzig, Germany

Strategic partner

Already now, the DCC has concluded useful partnerships that will help them to successfully build their platform in the future. Here are some of them :

DATA - blockchain based digital data authentication protocol powered be AI & P2P mobile storage infrastructure.

TONGNIU Tech is a leading Saas Financial Technology Company in China.

JUZIX is a world leader in the area of distributed Ledger. Will provide all technical assistance in the creation of DCC.

WXY is a universal platform for global marketing and consulting of digital projects.

The DCC project also has early investors who understand the importance of this platform for the banking system and who are confident in the success of this project:

Hu Sen is an entrepreneur. Ex-Googler. Awarded 30 Under-30s by Forbes China in 2014 and by Forbes Asia in 2016 for outstanding achievements of founding CLOUNDACC.

Mai Zizhao - crucial investor Telegram-TON .. Co-founder of the MathTrust, Feiyue Education.

MathTrust is a laboratory created for experiments and observations in the blockchain network.

Feiyue Education is the first institution in China that provides training in 2 languages. The program for the training of students developed on their own.

Xu Jizhe - Founder Newton Project. The project is named after Isaac Newton. Co-founder Elastos. Elastos is the Internet of the future, where many applications will be decentralized and surfing completely safe.

Result:

It seems to me that this project, after a while, has a very great chance to become a leader in the banking sector among companies working with the help of blockchain technologies. A strong team, a clear action plan, reliable partners and investors ' confidence in the project should become an accelerator for the DCC.

I hope you enjoyed my little review of the project. Thank you for attention!

Link to project:

Official Site : http://dcc.finance

Twitter (17.4 K Followers) : https://twitter.com/DccOfficial2018/

Linkedin : https://www.linkedin.com/company/distributed-credit-chain/

Telegram ( 34.8 K Followers) : https://t.me/DccOfficial

GitHub : https://github.com/DistributedBanking/DCC

ICO Drops : https://icodrops.com/dcc/

Whitepapper DCC : http://dcc.finance/file/DCCwhitepaper.pdf