KABN.NETWORK

Hi guys! I will be giving you a review about the KABN Project, About the company, token information, roadmap, Team and many more. So i begin by explaining exactly what KABN entails.

ABOUT KABN

The KABN Network is an integrated suite of financial services that includes the Pegasus Flyte Visa Card, an approved crypto-linked prepaid Visa card and mobile integrated multi-currency banking wallet. KABN is a neo financial service platform servicing Millennial and Gen-X retail investors. They are compliance service providers Company at a very low cost in exchange for obtaining licence to issue Visa card accounts and access to the corresponding KABN banking wallet. KABN monetizes card holders through card transaction fees as well as through loyalty and affiliate commissions.

KABN supports internationally recognized documents for Know Your Customer (KYC) regulations. In addition, for issuers of private or early stage assets, KABN provides qualification for investors in the United States and Canada, and source of wealth verification for investors in Europe. To date, KABN has screened individuals in the following countries: Armenia, Australia, Bangladesh, Belarus, Canada, Ecuador, Hong Kong, India, Indonesia, Ireland, Latvia, Malaysia, Nigeria, Philippines, Romania, Russian Federation, Sri Lanka, Thailand, Turkey, Ukraine, United Kingdom of Great Britain and Northern Ireland, United States of America and Vietnam. Other countries will be added as they come on board. Customers on the KABN network receive ongoing Anti-Money Laundering (AML) monitoring and requests to confirm or update personal information that is expired or out of date. Financial technology startups can outsource this operational burden at no extra charge.

Issuers and financial technology startups operating at a global scale are required to comply with United States banking regulations. Know Your Customer (KYC) regulations involve managing private and sensitive personal customer information and the third-party verification of these documents. Anti-Money Laundering (AML) regulations require screening and monitoring participants against international sanctions, politically exposed persons flags (PEP), and adverse media lists. Issuers and startups must additionally comply with European regulations around data privacy and source of funds.

General Data Protection Regulation (GDPR) requires all technology services, encompassing financial technology services, to give users the ability to retrieve all personal data and the right-to-be-forgotten. Management has determined that existing compliance and customer onboarding is often manual, time-intensive, and costly. In-house compliance programs are typically inadequate and/or data gathered is incomplete, inaccurate or unverified. Third-party services and compliance experts may be too expensive for issuers that are required to perform compliance in order to raise capital. For transactions related to international blockchain-based offerings, many issuers are unfamiliar with global regulations outside of their jurisdiction. In some cases, issuers do not comply with U.S. Securities and Exchange Commission (SEC) regulations and have improperly sold tokens into the US market without an exemption to registration. Over the course of 2018 the SEC significantly increased the scope and instances of repercussions, often forcing issuers to return all funds to investors, sometimes resulting in charges and convictions. In today's market, compliance has become central to any business attempting to raise funds.

KABN changes the trend with the integration of a global identification (KABN ID), which is a medium of collecting users’ data and storing the same in an encrypted database. The data, in this case, will be free of malicious access because it works on the premise of Personally-Identifying Information (PII) – users will confirm their identity before getting access to the data. This identity (ID) verification and validation is GDPR-compliant and is available in over 180 countries.

This friction-free global identification (Global ID) system uses the identity validation and verification compliance solution (Always On) to verify the identity of users.

The Crypto-Linked Card

It is quite hard to spend crypto coins on physical goods and services. This has been the major downside to digital assets. It also reduces its stake at getting more adoptions. The current means of accessing crypto funds is loading the assets to debit cards using third-party platforms, such as Cryptopay and BitPay.

KABN HASH

It is on this premise that KABN brings forth its Neo-Bank approach. The approach entails returning some dividends to users in forms of reduced cost of transactions and loyalty programs. In this case, KABN HASH, which is the platform’s reward mechanism, redistributes rewards to end-users.

Users will shop on fiat stores and online merchandise websites. When they pay with their Pegasus Flyte Visa Card, KABN earns some commissions. At the end of it all, the platform calculates the amount gained from each user’s transactions and rewards prospective users with 5% of the accrued dividends.

KABN ID

KABN gives start to finish client confronting applications at, what the executives fights, is a lower value point than customary backend specialist organizations. Customers who use KABN expel the migraine of structure their very own application and accelerate the consistence procedure for members definitely known to the KABN network.

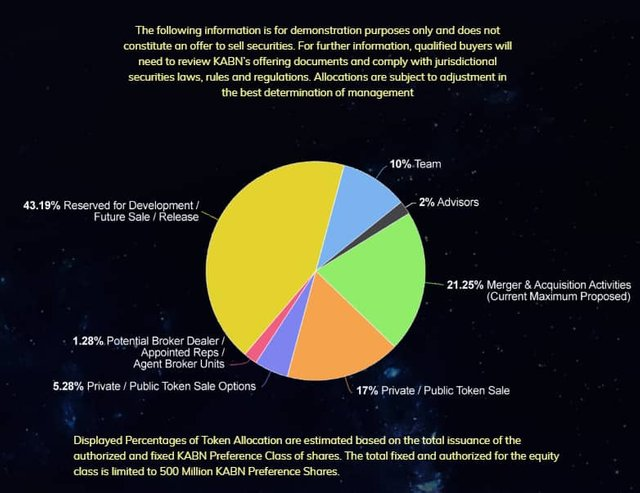

TOKEN DETAILS

Token: KABN

Type: Utility

Price 1 KABN = 0.2 USD

Platform: Ethereum

Accepting: ETH, BTC, Fiat

Country: Gibraltar

Whitelist/KYC KYC

TEAM MEMBERS

BENEFITS OF KABN PLATFORM

● One-time registration and ongoing monitoring - meets all legal requirements

● Separates PII from technology and remains compliant with jurisdictional privacy

requirements

● Issuers can bring future token offering to already approved customers that have a

propensity to buy into STO's and reach qualified participants

● Blockchain registries provide up-to-date information on-chain

● Customers can provide further "aggregate" information to receive early access to STO's

and other commercial offers (under GDPR privacy provisions)

● Privacy Shield (US – pending) means US customers follow the same principles as

global privacy community.

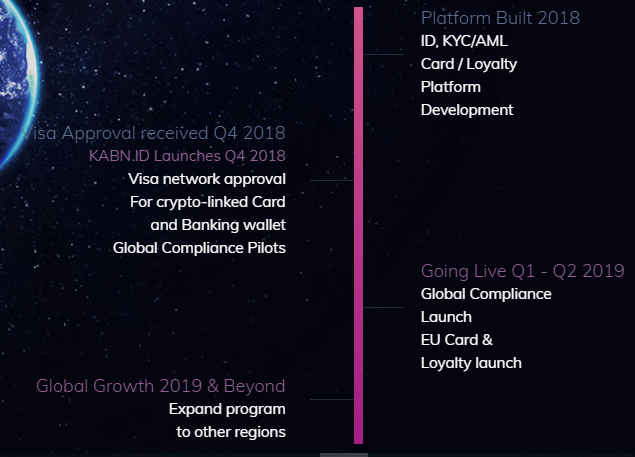

ROADMAP

As cryptocurrencies and other digital currencies take hold and grow globally, there is an ever-increasing need to be able to convert those currencies back to traditional currencies, such as United States Dollars or Euros, in order to make them spendable in the real world.

KABN’s integrated suite of products, which has received approval by Visa, solves this real and growing challenge by empowering digital currency holders and KABN cardholders alike to be able to spend in-store, online, and access ATMs globally, wherever Visa is accepted.

In the US alone, this type of card volume is expected to grow to over $396B by 2022. Worldwide volume will follow the same trajectory and expected growth is exponential.

For more information, visit the project links below;

Website : https://www.kabntoken.com

WhitePaper: https://www.kabntoken.com/wp-content/uploads/2019/03/KABN-Company-Overview-Summary-V1.2.pdf

Medium : https://medium.com/@KABN

Twitter : https://twitter.com/KABNNETWORK

Telegram : https://t.me/kabn_network

LinkedIn : https://www.linkedin.com/company/kabn/

Bounty0x Username:

temillion