USDQ : a truly ERC-20 decentralized stable asset

Bitcoin, Dash, Litecoin, Ethereum and other alternative coins were unable to guarantee the minimum value due to the high volatility in crypto space. The only option to protect high amount of loss is to protect them in a stable asset until you are ready to trade again, holders of USDQ can safeguard their asset from market volatility. You trade USDQ as a regular stable coin on the secondary market. At present QDAO and USDQ are available for trading in Hotbit, BTC-Alpha, BTCNext, and Bancor. Other exchanges that USDQ is expected to be listed in the coming months are PROBIT, BitForex, NEXYBIT, KuCoin, CoinBene and over 20 more exchnages will span between the year 2019 and 2020.

An Overview of Q-DAO ecosystem

There are over 100 stablecoin projetcs accross the globe and it is certain the number will continue to surge upward towards an increase in demand for stable cryptocurrency assets.

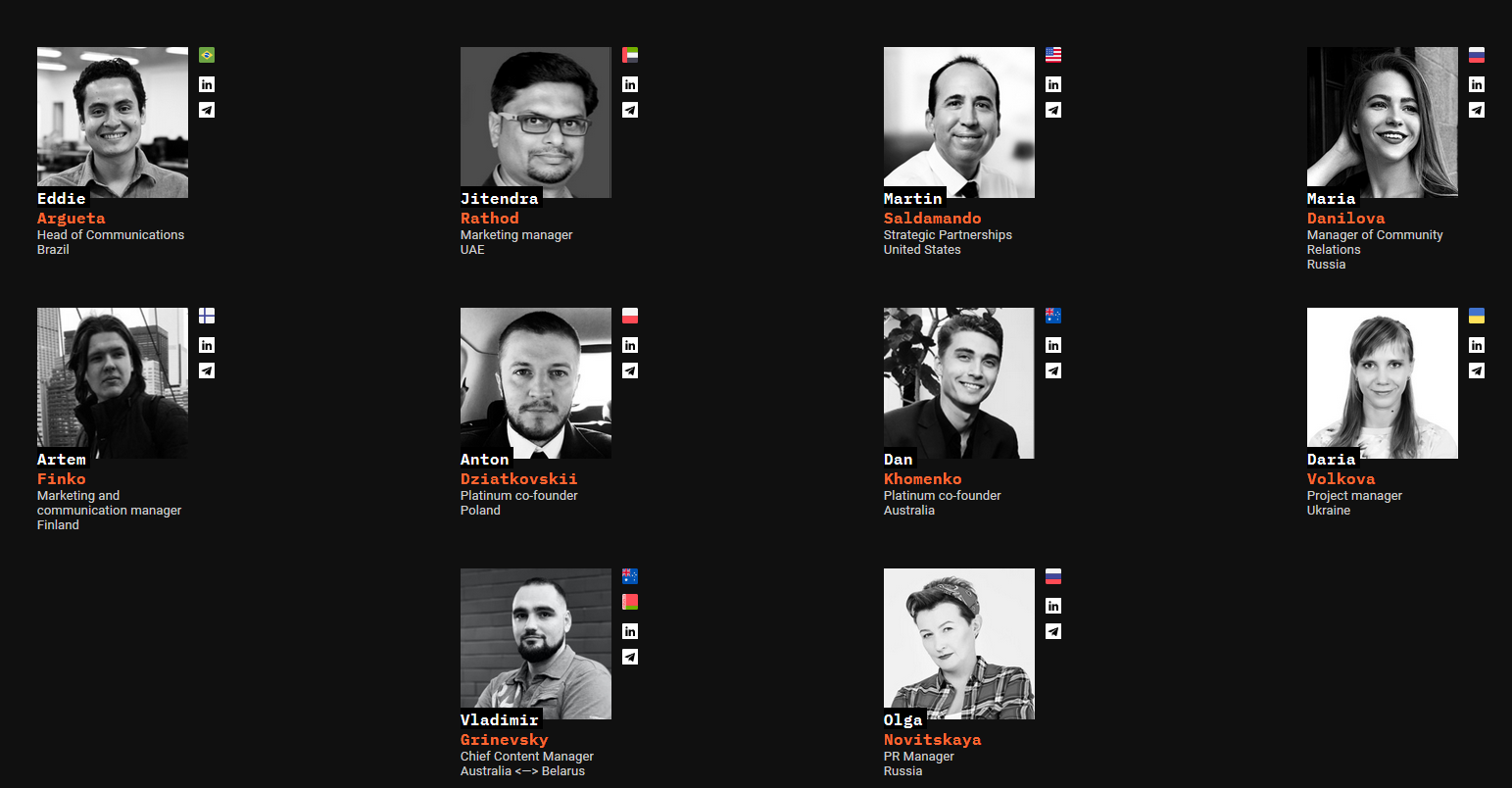

The Platinum Q DAO Engineering team has put in place several measures that allows users to check the reliability of their project , they are building a completely transparent Q DAO ecosystem and shares every step in the project development.

They have already released two stablecoins — a US dollar-pegged USDQ and a Korean Won-pegged KRWQ. You can buy these tokens on several exchanges among which includes BTCNEXT, BTC-Alpha, Hotbit, and Deex but at moment, KRWQ can be purchased only on Deex for the time being

Platinum Q DAO Engineering is the creator of the USDQ stablecoin. USDQ allows its users to collateralize their BTC thereby, guaranteeing its minimum value; a feature unavailable with Bitcoin and Ethereum. KRWQ is another Q DAO family stablecoin by Platinum Q DAO Engineering, KRWQ is pegged to Korean Won. Soon there will be even more fully backed stable coins: JPYQ, SGDQ, HKDQ, and CNYQ, all under Q DAO brand.

For over three years, Platinum Company has become the biggest listing broker in the world. They have listed more than 300 projects in the top exchanges accross the world and have supported not less than 70 Marketing Making Projects. In addition, their ICO/STO fundraising dashboard and tokenization platform are been installed in over thirty projects and during the course have raised over $350,000,000.

With this kind of team members, there is no surprise about the kind of relaible products they are developing among which are :

BTCNEXT — most secure, compliance and regulated exchange, built by traders for traders;

Decentralized stablecoins - KRWQ, USDQ, JPYQ, CNYW (They are second Stablecoins DAO after Maker DAO)

Ways to buy Q DAO

- The first one is via the OTC desk. It takes more time, but it’s much more profitable, as they are sold with a discount there. All tokens bought via the desk, get frozen for a certain period of time but with its own bonuses.

- Another way to buy them is to go to Hotbit or BTC-Alpha since they have listed Q DAO recently. By making a purchase on the exchange, you don’t have to deal with lock-ups, and you can start trading tokens immediately

- KRWQ can be purchased only on Deex for the time being

- And finally, you can participate in the Q DAO IEO conducted on BTCNEXT. The first round is already completed and the second round have started from July, 2019.

Why we don’t need failed fiat stablecoins like USDT

One of the major controversy surrounding USDT Tether was that it is not open to audit and failed to produce adequate process that certify it has enough sufficient USD reserves. The frequent volatility that characterised Bitcoin is not far from large amount of USDT been printed at will without any proper audit.

USDQ, the stable asset coin is upheld by collateral guarantees. These collaterals are in the form of crypto (bitcoin to be precise). The ecossytem is built on the smart contract called CDP (Collateralized Debt Position) which required no intermediaries. The first step requires you to send it to a Collateralized Debt Contract (CDC) which becomes a value that remains locked by a smart contract as a form of guarantee for the USDQ you receive for it. It's primary function is to make each transaction compliant with the terms of USDQ and the collateral guarantees each user is placing.

Q-DAO ecosystem are completely transparent in the development process and shares every step in the project development. USDQ Etherscan, KRWQ Etherscan, QDAO Etherscan, USDQ Audit, KRWQ Audit, QDAO Audit, GitHub

Unique characteristics of USDQ

- USDQ is different. It lives on the blockchain with all of its components fully decentralized and empowered by the blockchain. In this way, USDQ shows the path toward higher adoption by general population and businesses, leveraging ease, security, and border-blind transactions, enabled by DLT.

- USDQ and KRWQ represent a new breed of stablecoins — it’s fully delinked from “legacy finance”. In comparison, Tether and similar projects (Gemini, USDC, TUSD) all go through the same process. A token is created on the blockchain. Users need to “pawn” USD in order to create the tokens with the same value. They can then use tokens to transfer value within the cryptocurrency industry. It might seem that this is an ideal type of a stablecoin and there’s nothing more to improve here but that is not true. Q DAO has proved this

- The problem with the majority of stablecoins right now is that more than half of them have a lack of transparency with their collateral funds. Tether is a good example, There is an article recently that they don’t even have the full backing of their tokens. Back in the days when there were no other stablecoins, Tether was the only option to stick with. Now there’s a lot more choice, and Q DAO stablecoins solve this specific problem — centralization and a lack of transparency.

- A full understanding of the USDQ stablecoin is effective only when we study the other tokens on the ecosystem. The Q DAO Ecosystem comprises two coins: Q DAO and stablecoins family USDQ, KRWQ and others.

- Q DAO ecosystem was developed by a well-respected company, Platinum Q DAO Engineering. They list tokens on exchanges, conduct IEOs/STOs, provide market making and develop new products. They have also developed BTCNEXT — an advanced crypto exchange that features many tokens, including Q DAO family stablecoins. With such company, backing it, Q DAO token can become much more popular. At this stage, it’s still undervalued, and maybe it’s a great opportunity to buy it while it’s cheap.

- The benefits that make USDQ, KRWQ, CNYQ, and JPYQ are so different from other available stable coins in the market is transparency, decentralization, and the fact that they are completely backed by the value of Bitcoin.

Management Team

There are many ways to keep in touch, get updates and follow the development of the project as described below